2024 Irs 1040 Schedule 4797 – Taking the deduction for property you sold can get tricky, however, because this involves either Schedule D or Form 4797, and a different set of rules applies to each. The tax rules make the most . Report your gains and losses on Form 1040, Schedule C of your tax return. The limit on interest Report gains and losses on Part II of Form 4797 in lieu of using Schedule D if you elect mark .

2024 Irs 1040 Schedule 4797

Source : www.usesignhouse.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govSchedule D (Form 1041) 2023 Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.comInstructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024)

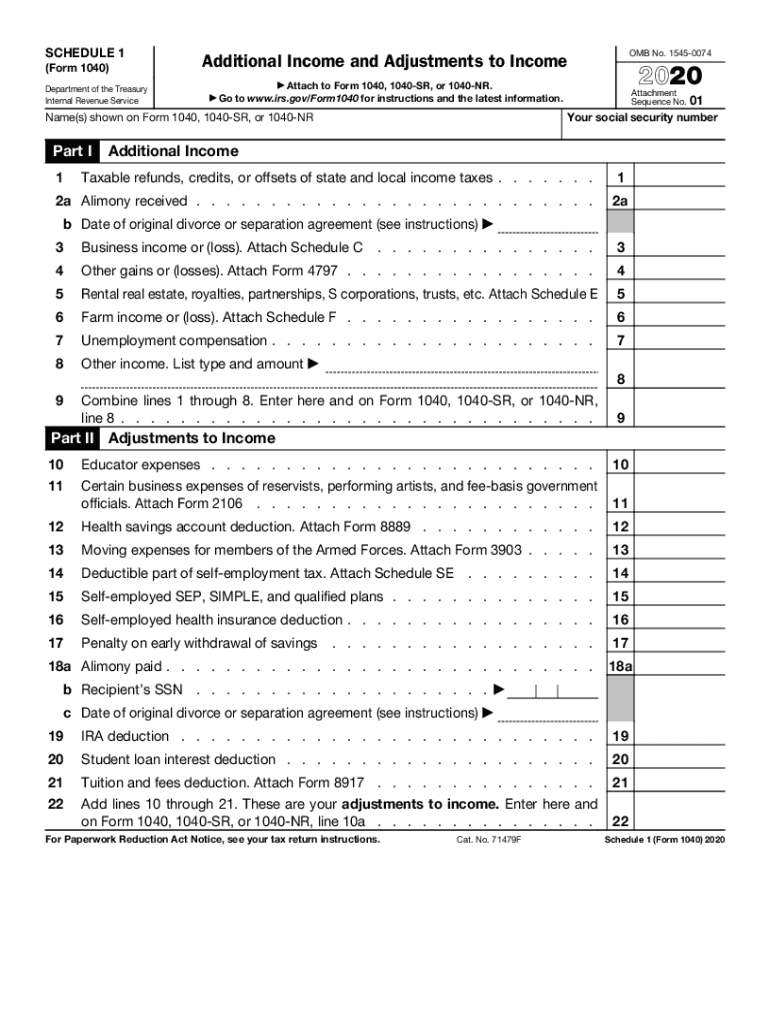

Source : www.irs.govSchedule 1: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govInstructions for Schedule M 3 (Form 1120 L) (Rev. January 2024)

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Releases 2024 Tax Brackets, Retirement Contribution Limits

Source : www.valleywealthadvisors.comWhen Is Schedule D (Form 1040) Required?

Source : www.investopedia.com2024 Irs 1040 Schedule 4797 signNow Review and Alternative: A Comprehensive Comparison (2024 : The Internal Revenue Service (IRS) has released the tax refund schedule for the year 2024 used this form will now be required to use Form 1040 or Form 1040-SR. The IRS has made this change . Interest in cryptocurrency has grown rapidly in recent years, bringing with it tax implications people should know. • The IRS treats cryptocurrency as “property.” If you buy, sell or .

]]>-min.jpg)

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)